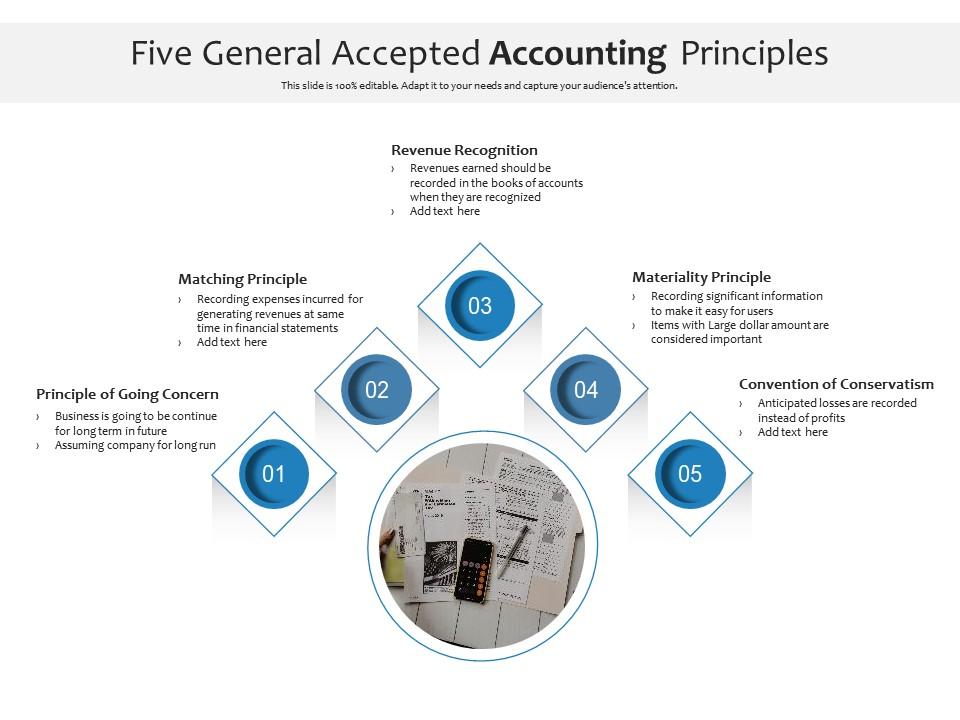

Five General Accepted Accounting Principles Presentation Graphics

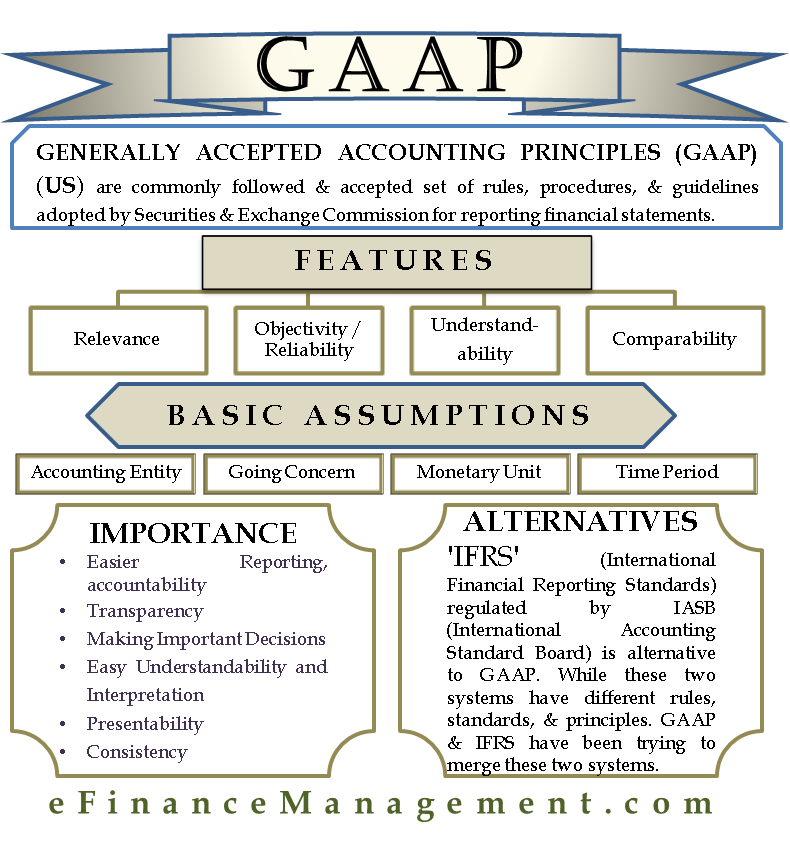

Generally accepted accounting principles, or GAAP, are standards that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices.

PPT 1.01 Generally Accepted Accounting Principles Definition and

GAAP is an acronym for Generally Accepted Accounting Principles. These principles constitute preferred accounting treatment. GAAP includes definitions of accounting concepts and principles, as well as industry-specific rules. The main purpose of GAAP is to ensure that financial reporting is transparent and consistent from one organization to.

PPT Generally Accepted Accounting Principles PowerPoint Presentation

Generally accepted accounting principles (commonly referred to as GAAP or US GAAP) are the common accounting rules that must be followed when a U.S. company prepares financial statements that will be distributed to people outside of the company. These common rules range from basic underlying principles and assumptions to the detailed rules.

Nguyên tắc kế toán được chấp nhận chung (Generally Accepted Accounting

Generally Accepted Accounting Principles (GAAP or US GAAP) are a collection of commonly-followed accounting rules and standards for financial reporting. The specifications of GAAP, which is the standard adopted by the U.S. Securities and Exchange Commission (SEC), include definitions of concepts and principles, as well as industry-specific.

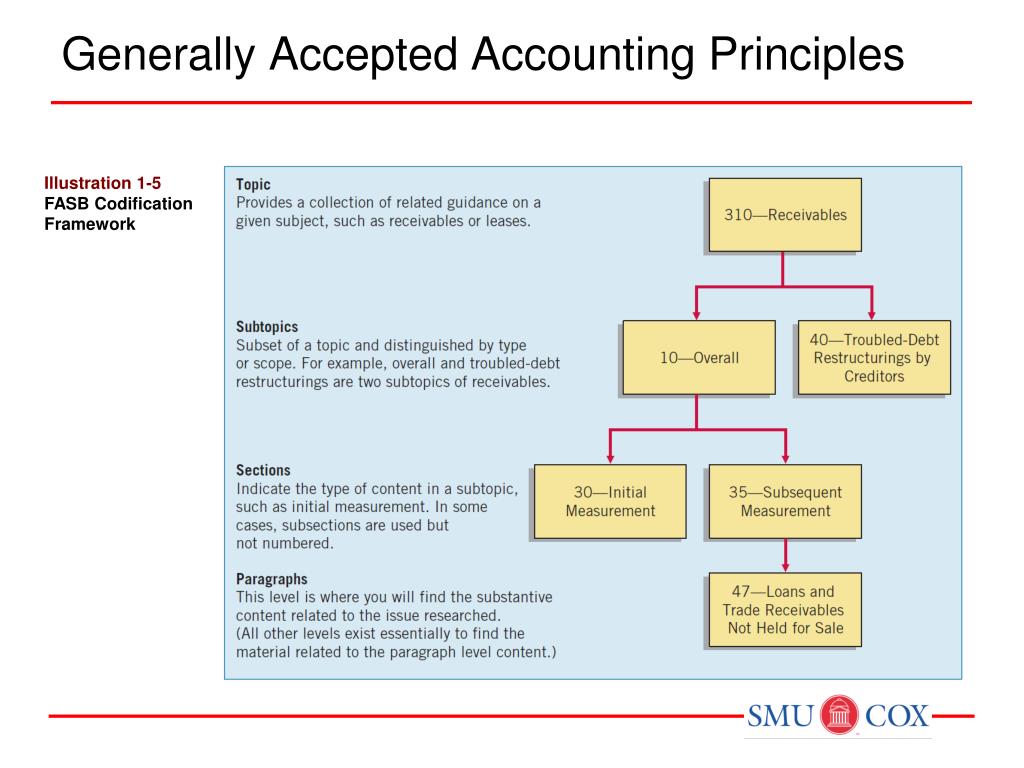

PPT Intermediate Accounting I Greg Sommers, PhD CPA PowerPoint

Standards & Guidance. The FASAB Handbook of Accounting Standards and Other Pronouncements, as Amended (Current Handbook)—an approximate 2,800-page PDF—is the most up-to-date, authoritative source of generally accepted accounting principles (GAAP) developed for federal entities. It is updated annually to incorporate pronouncements issued by FASAB. This year's edition incorporates Board.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles - GAAP: Generally accepted accounting principles (GAAP) are a common set of accounting principles , standards and procedures that companies must follow.

Home > IFRS > Generally Accepted Accounting Principles in 2021 [Updated]

GAAP (generally accepted accounting principles) is a collection of commonly followed accounting rules and standards for financial reporting. The acronym is pronounced gap. GAAP specifications include definitions of concepts and principles, as well as industry-specific rules. The purpose of GAAP is to ensure that financial reporting is.

PPT CHAPTER2 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES & ACCOUNTING

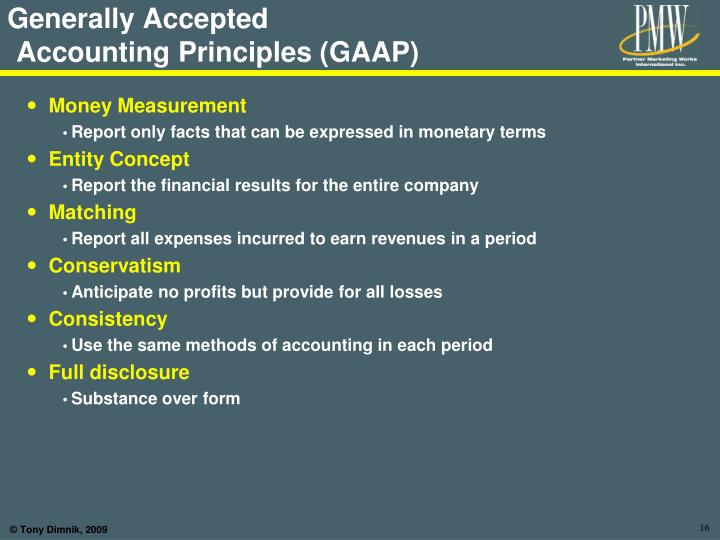

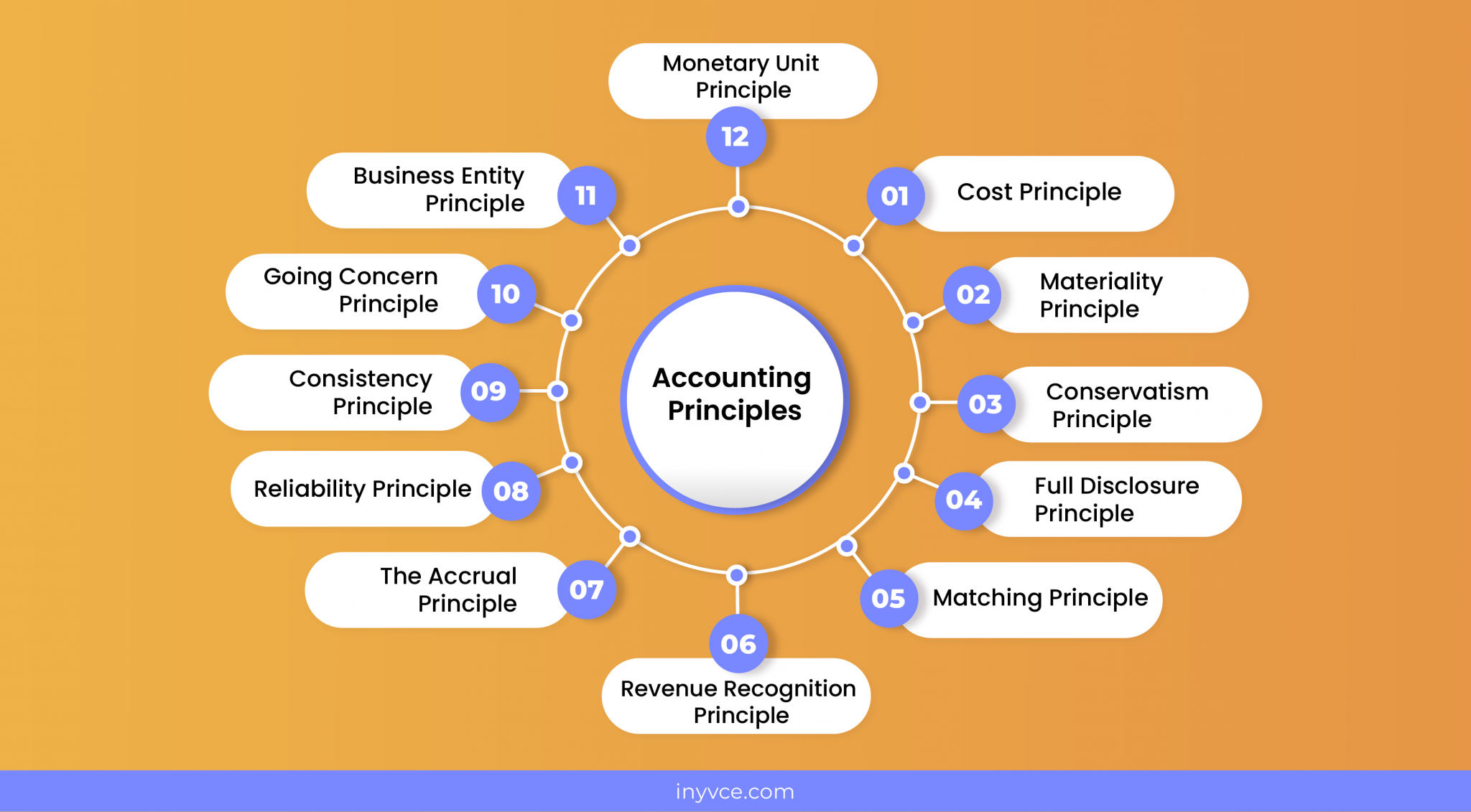

In short, generally accepted accounting principles (GAAP) are a set of commonly followed accounting standards and rules for financial reporting. The standards include definitions, concepts, principles, and industry-specific rules. In other words, GAAP is a collection of concepts and best accounting practices accepted throughout the industry.

generally accepted accounting standards Accounting gaap principles

March 31, 2023. Generally Accepted Accounting Principles (GAAP) are a set of rules, guidelines, and principles that U.S. companies of all sizes and across industries adhere to. In the U.S., these accounting standards have been established by the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public.

Generally accepted accounting principles are mobisilope

The GASB establishes accounting and financial reporting standards for U.S. state and local governments that follow generally accepted accounting principles (GAAP). The Governmental Accounting Research System™ (GARS) provides access to those standards.

PPT Generally Accepted Accounting Principle PowerPoint Presentation

Generally Accepted Accounting Principles were eventually established primarily as a response to the Stock Market Crash of 1929 and the subsequent Great Depression, which were believed to be at least partially caused by less than forthright financial reporting practices by some publicly-traded companies. The federal government began working with.

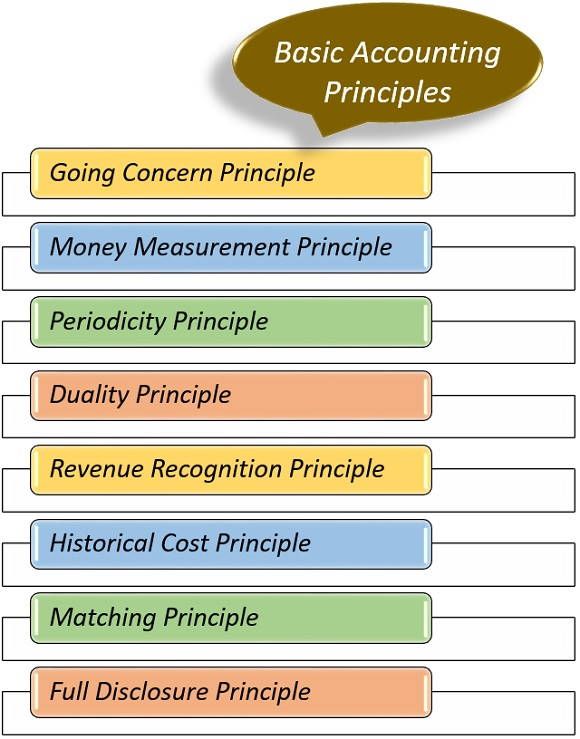

Basic accounting principles gulfpics

The final constraint under generally accepted accounting principles is the cost constraint principle. This is also one of the trickier principles, because it can be hard to quantify.

12 basic accounting principles

Financial Disclosure Checklist Wiley GAAP 2020: Interpretation and Application of Generally Accepted Accounting Principles Wiley Practitioner's Guide to GAAS 2019: Covering all SASs, SSAEs, SSARSs, and Interpretations Wiley GAAP: Financial Statement Disclosures Manual (Wiley Regulatory Reporting) Wiley Revenue Recognition. xiii.

Generally accepted accounting principal

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. The common set of U.S. accounting principles is the generally accepted accounting.

Generally Accepted Accounting Principles Meaning,History,Objectives,Etc

Generally Accepted Accounting Principles (GAAP or U.S. GAAP or GAAP (USA), pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC) and is the default accounting standard used by companies based in the United States.

:max_bytes(150000):strip_icc()/gaap.asp-Final-fcd73bc9aa6a4833bcb7f2bfe8bd3208.png)

Generally Accepted Accounting Principles (GAAP) Definition, Standards

Generally accepted accounting principles are a set of official, common standards of practice among accounting professionals. Accountants are responsible for adhering to GAAP when preparing financial statements and records for public organizations. The Financial Accounting Standards Board (FASB) issued these regulations to ensure financial.

- Magdalenas De Limon Super Esponjosas

- Evolucion De Tentacool Pokémon Esmeralda

- Clase Para La Drh Cod Mobile

- Pais Con Mejor Sistema Educativo

- La Reunification De Chypre Compromise

- Rodaballo A La Parrilla Tiempo

- Hyper Knuckles Super Chao Esmeralda

- Jo Nesbo Harry Hole Serie Volgorde

- Camara De Comercio Bogota Chapinero

- After En Mil Pedazos Película Completa En Español Gnula