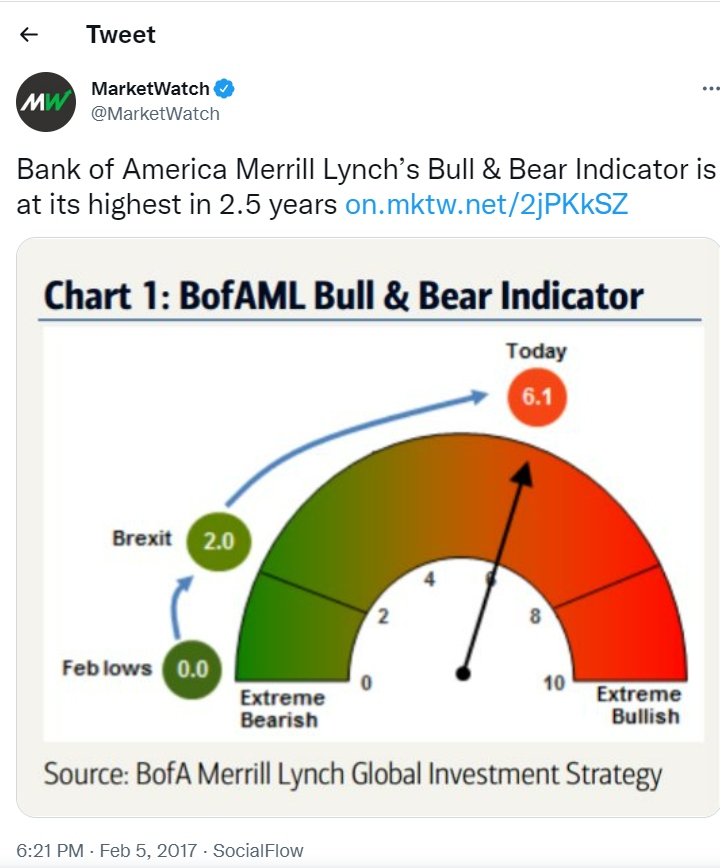

BofA Bull and Bear indicator signals a bullish week

The bank's custom bull-and-bear indicator rose to 6.8 in the week through Feb. 7, Hartnett wrote in a note. A reading above 8 would suggest the bullish trend has run too far, flashing a.

Radar Report 6.23.22 New World Investor Technology Stocks and More

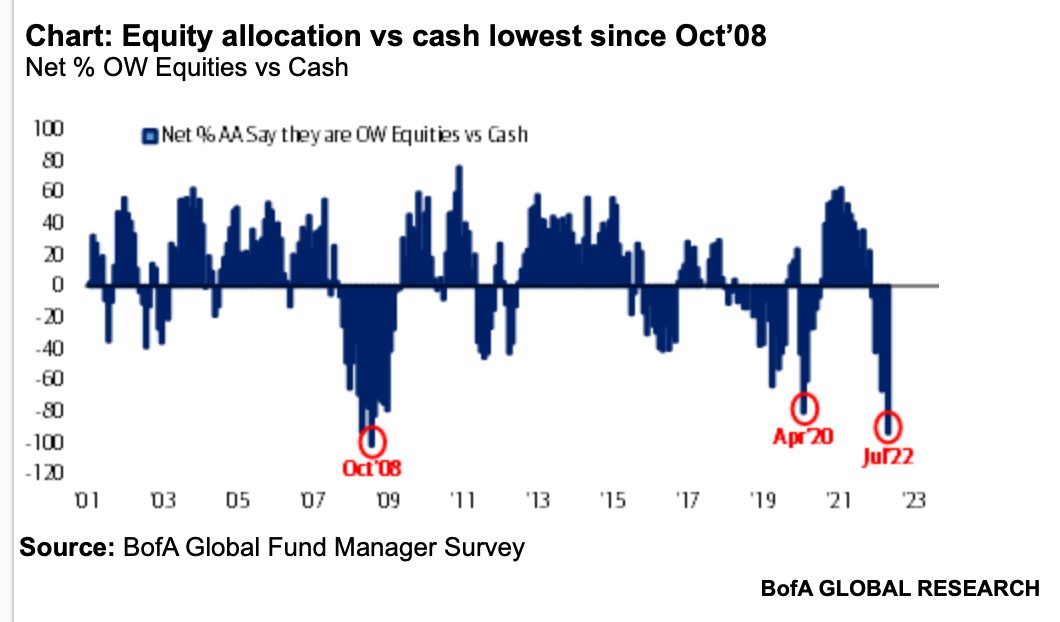

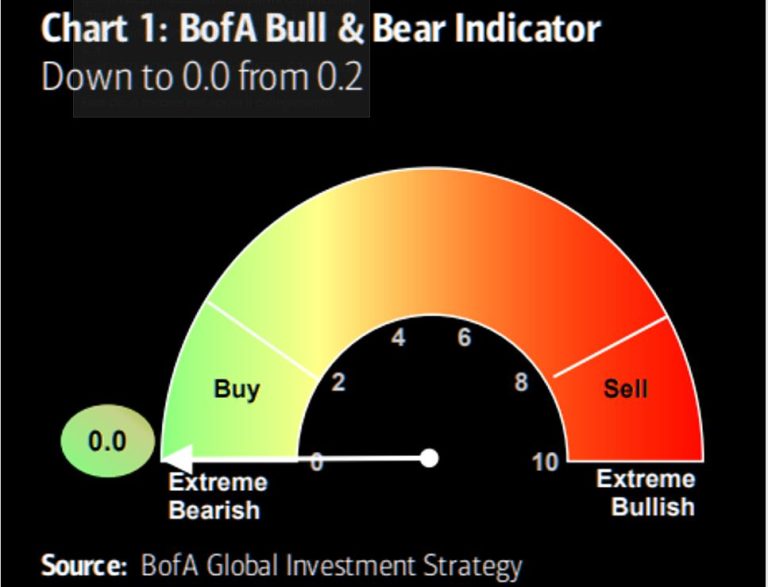

Finally, the Bank of America (NYSE: BAC) Bull & Bear Indicator has remained at 0, which signals "maximum bearishness" among investors. A reading below 2.0 signals "buy". "3 month returns.

Arun S. Chopra CFA CMT🧐 on Twitter "RT FusionptCapital BOFA's bull/bear indicator trying not

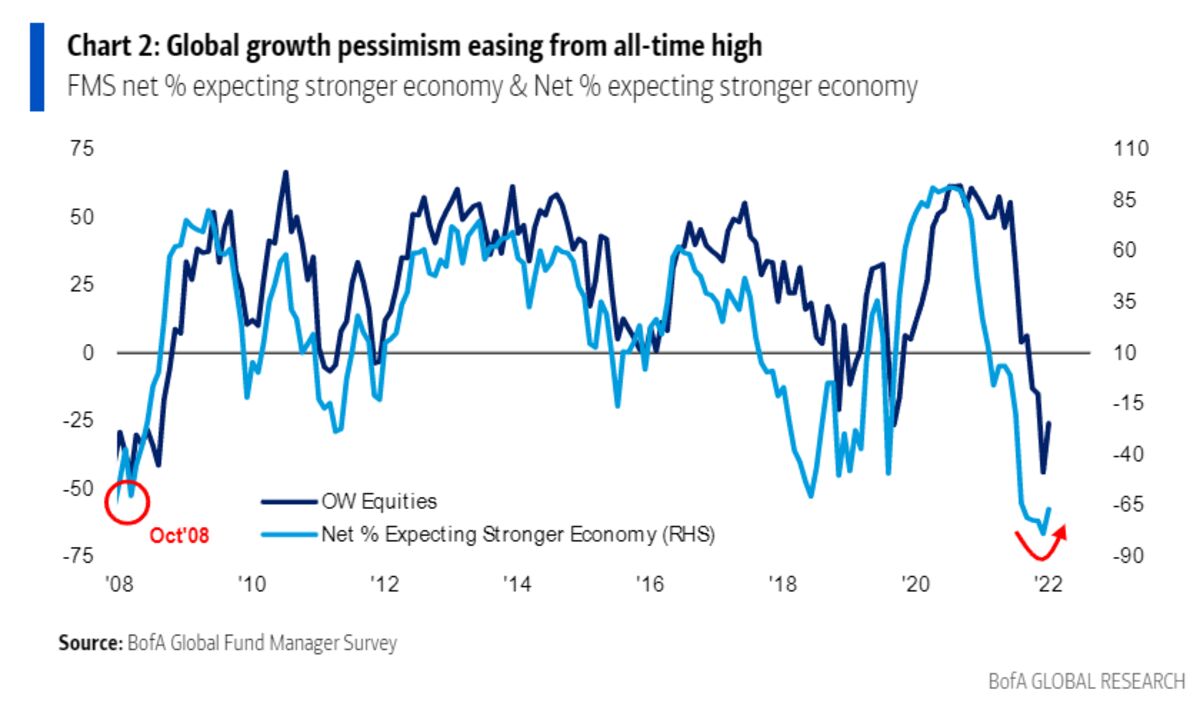

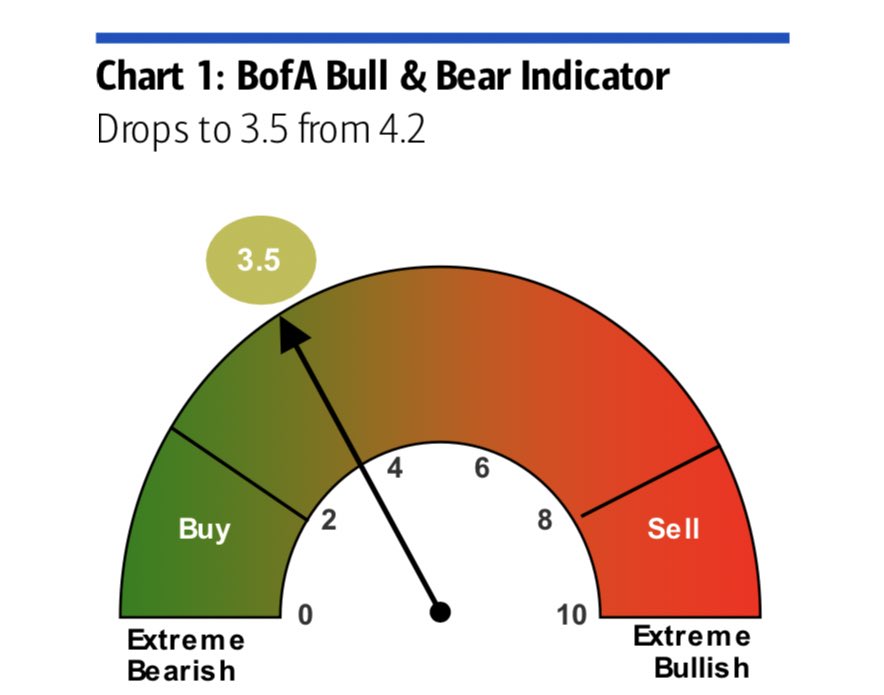

The bank's Bull & Bear Indicator is "accelerating toward extreme bullish", it said. It now stands at 5.8, up from 4.7; on a scale from 0 to 10. In concert with that indicator, the bank said fund.

BofA bull and bear indicator The Market Ear

BofA said its Bull and Bear indicator, a measure of market sentiment, dropped to 5.0 from 5.2 as outflows from stocks and high yield bonds outweighed a drop in cash levels from their fund manager.

Bull Bear Indicator

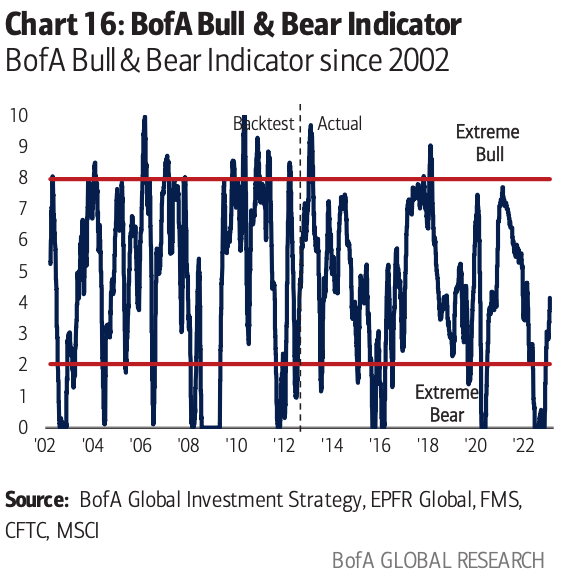

Written by Team Sang Lucci & Wall St. Jesus. Updated over a week ago. The BofA Bull & Bear Indicator is Bank of America's key investor positioning measure. The indicator ranges from 0 to 10, where: Below 2 is a considered bearish extreme and a buy signal. Above 8 is considered a bullish extreme and a sell signal.

oudeis 🇺🇦 🇹🇼🇲🇲 Freedom (political/financial) on Twitter "RT AyeshaTariq BoFA Bull and Bear

BofA's Bull & Bear indicator—which measures investor sentiment—was at the "maximum bearish" reading, the results showed, with recession anticipation among fund managers at its highest.

‘Dire levels of pessimism’ BofA Bull & Bear Indicator remains at ‘max bear’ IR Magazine

The Bull Power indicator attempts to measure the market's appetite for higher prices. Both do this by making a comparison to a third measure. This is a guide helping us see where the consensus of value lies within the market. Typically, a 13-period exponential moving average (EMA) is used for this base line of value.

BofA Survey Shows Investors No Longer ‘Apocalyptically’ Bearish Bloomberg

The Flow Show — The Investment Strategy team highlight their proprietary Bull & Bear Indicator that illustrates market sentiment based on recent flow data.. Global Proprietary Signals — a monthly report offering macro takeaways from the 50+ indicators maintained by BofA Global Research. Looking at these proprietary indicators.

2023 MARKETSBofA's "Bull & Bear" indicator at its lowest since 2020

BofA emphasized that its Bull & Bear Indicator is not intended to be used as a benchmark or a measure of performance for any financial instrument or contract. S&P 500 in a bear market

BofA Bull, bear market indicator triggers "buy" for risk assets

Bull-and-bear indicator drops to 1.9 amid bearish positioning;. The BofA bull-and-bear reading dropped to 1.9 from 2.2 in the week through Oct. 18, driven by outflows from emerging market debt.

BAML Bull and Bear indicator Atlas Wealth Management Group, LLC

BOFA BULL & BEAR INDICATOR UP TO 3.5, A 10-MONTH HIGH FROM 3.1 LAST WEEK, ON EMERGING MARKET INFLOWS. -January 20, 2023 at 06:15 am EST - MarketScreener

BofA Bull&Bear pokazał zero i kusi do kupowania akcji GPW ATAK inwestycje na giełdzie

That's according to a team led by Michael Hartnett, Bank of America's chief investment strategist, who said their Bull & Bear Indicator is now in "extreme bearish" territory at 1.9 from a previous.

Compounding Quality on Twitter "Institutional investors have almost never had as much cash as

On Thursday, BofA's Michael Hartnett said the Bull & Bear indicator (the bank's flagship positioning signal) flashed a contrarian buy signal after diving to 1.3 from 2.4. It's the first buy signal.

TOTAL ZERO Bull and Bear Indicator (BofA) IntermarketAndMore

In depth view into US Investor Sentiment, % Bull-Bear Spread including historical data from 1987 to 2024, charts and stats. US Investor Sentiment, % Bull-Bear Spread (I:USISBBS) 4.31% for Wk of Apr 18 2024 Overview; Interactive Chart; More. Level Chart. Basic Info. US Investor Sentiment, % Bull-Bear Spread is at 4.31%, compared to 19.40% last.

Carl Quintanilla on Twitter "B of A “.. the perfect market low is combo of extreme bearish

A contrarian buy signal for riskier assets is triggered when the bank's so-called Bull & Bear Indicator drops under 2.0.. Read: RBC and BofA see S&P 500 heading to 5,000 in 2024, but here are.

BofA indicator issues strong warning

BofA's Bull & Bear Indicator is at 2.0, on the cusp of signaling Buy. By Senad Karaahmetovic. BofA's Bull & Bear Indicator Now 'Extremely Bearish', Close to Signaling 'Buy'

- Impuesto Transmisiones Patrimoniales Año 2011 En Catalunya

- Circular A Una Velocidad Inadecuada

- Quiniela De Futbol Jornada 42

- Combinaciones Con Traje Gris Oscuro

- I Just Wanna Blow Your Mind Lyrics

- Moto De Agua Yamaha 300 Cv 2021

- 29 De Julio 01 00 Cest

- Boda En La Playa Vestidos De Novia

- Golf Gti 2022 Ficha Técnica

- Que Le Pasaba A Maria Teresa Campos